Home / Uranium market

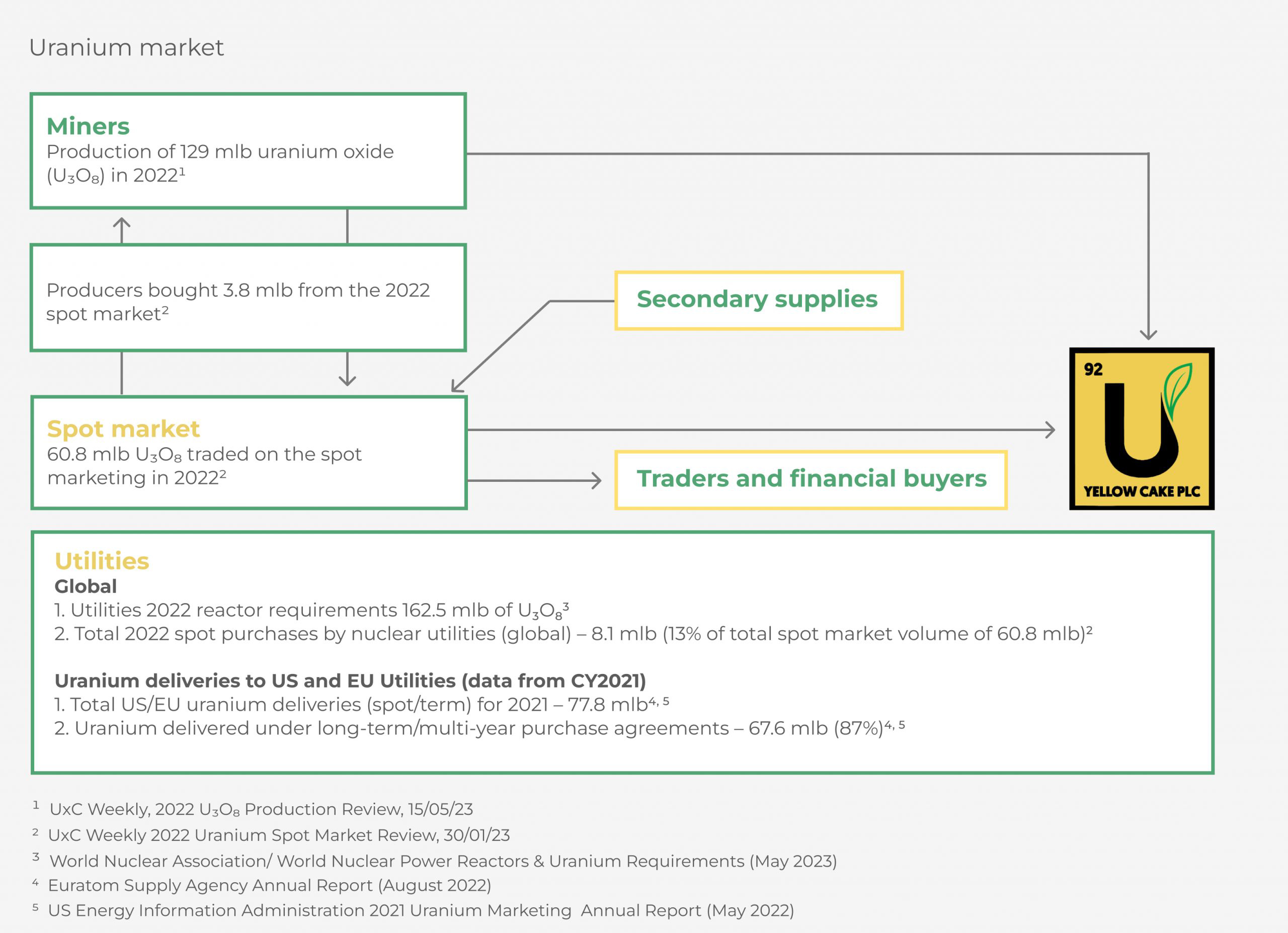

Since 2018 the sentiment towards nuclear energy has improved in the context of net zero carbon commitments, concerns around concentration of supply and an increased focus on energy security following Russia’s invasion of Ukraine. The U3O8 price has started to respond positively as the supply/demand imbalance has become more widely recognised.

Demand side drivers

+ Long-term growth in global electricity demand

+ Strong growth forecast for nuclear in the large developing economies in Asia

+ Low carbon emission energy source supporting 2050/2060 country emission targets

+ Increased focus on energy security in light of geopolitical developments is driving a rethink in energy policies in countries that previously moved away from nuclear

+ Nuclear’s ability to provide reliable and predictable electricity to complement renewable sources

+ Progress in developing small modular reactors (“SMRs”) with reduced capital costs and footprint

+ Increased activity in the spot market from financial intermediaries

+ Contracting by nuclear power utilities for future uranium purchases has started to increase from historically low levels

+ Overhang of secondary supply has largely eroded

+ The growth of data centres and artificial intelligence, which requires greater amounts of reliable electricity

– Resistance regarding perceived potential environmental and safety impact is reducing

Supply side constraints

– Concentrated resources (three countries produce 68% of the world’s annual uranium production) increase the risk of supply disruptions due to geopolitical events or other factors

– Significant historical resources reached end of life in 2021 (Ranger and Akouta)

– Exploration and development of new resources has been uneconomic during an extended period of depressed uranium prices

– Cost inflation, supply chain disruptions for essential inputs and industry skills shortages are affecting producers’ ability to increase production, restart idled capacity and develop new resources

– Producers continue to show discipline at current prices

Uranium consumption*World Nuclear Association/World Nuclear Power Reactors & Uranium Requirements (May 2023)

Uranium production (2022) *UxC Weekly, 2022 U3O8 Production Review, 15/05/23

The front end of the nuclear fuel cycle is a complex process in which uranium can take up to 18 months to travel from mine to reactor*OECD-NEA, The Economics of the Nuclear Fuel Cycle (1994). While there are nuclear reactors in 32 countries around the world*World Nuclear Association/ World Nuclear Power Reactors & Uranium Requirements (May 2023), the majority of uranium production, conversion, enrichment and fabrication take place in relatively few places.

Uranium is mined using in-situ leaching, open pit and underground mining.

Heat from nuclear fission produces steam that drives turbines to generate electricity.

Copyright © 2023